Reading Time: 8 minutes

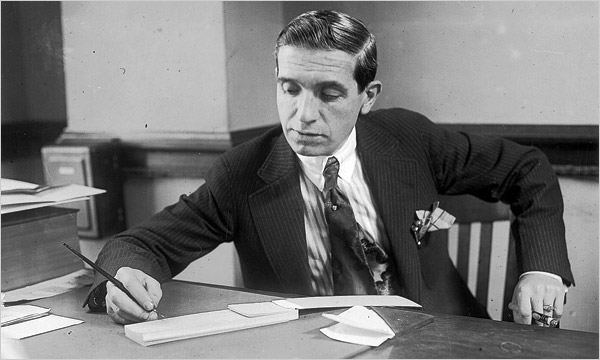

A hundred years ago, in 1920, Charles Ponzi became famous when his investment scheme based on postal reply coupons collapsed. Ponzi promised to double investors’ money in three months. At his peak, he brought in more than two million dollars per week at his offices in downtown Boston. Then, his house of cards came crashing down. A Ponzi scheme is a form of fraud where investors are lured in by the promise of high profits. They work by paying earlier investors out of the money that comes in from more recent ones. The scheme works as long as there is a constant flow of new investors or if old investors don’t take their money out. Charles Ponzi did not invent this scheme, but due to the notoriety of his case, this con, which used to be called the robbing Peter to pay Paul scheme, was renamed the Ponzi scheme.

Around 90 years later, Bernie Madoff was all over the news headlines for the exact same reason. Madoff had taken the Ponzi scheme and ran it on a much larger scale. Prosecutors estimated that the fraud was worth 65 billion dollars. While Ponzi’s scheme burned out in less than six months, Madoff’s scheme lasted for 20 years. While many are familiar with Madoff, few realize that dozens of Ponzi schemes are uncovered every year. The true toll of these Ponzi schemes on the economy is unknown, but whenever you’re being pitched something that seems too good to be true, odds are it is.

Lots of Ponzi-type schemes are being pitched in video adverts on YouTube every day. Because there are so many of these scams, I’ve put together a collection of the strangest 10 Ponzi schemes. There are some really crazy schemes out there. If there’s one you think I should have included that I didn’t, let me know in the comments below.

Coming in at number 10 is the Yilishen Tianxi Group, a Chinese company that sold traditional Chinese medicine products made from ants. More than a million people invested by buying and raising boxes of Black Mountain ants with the promise that they could sell the ants back for a profit. The scheme was endorsed by many Chinese celebrities before it was exposed as a Ponzi scheme in 2007. During the life of the scheme, the founder was praised by several members of the Chinese government as one of the country’s entrepreneurial leaders. Wang Zhendong, the company’s founder, promised returns of up to sixty percent per year for buying kits of ants and breeding equipment from two companies that he had set up. The boxes at the heart of the ant farming business were all made out of cardboard with a 2-inch square plastic window and a small feeding hole, held together with duct tape, making them look like the work of a child. In exchange for their money, ant farmers were given the boxes, some ants, and a list of strict feeding and care instructions. The company would come and pick up dead, dried ants every 74 days. Under no circumstances were the ant farmers to open their boxes and look inside, to ensure that the special ants weren’t mixed with inferior ants.

Wang promoted his products through advertising, and over an eight-year period, the company recruited as many as 1 million would-be ant farmers, collecting about 1.2 billion dollars. Most of the victims invested with the company because of its close ties with the government and due to endorsements by prominent officials. Wang was arrested after a riot that saw more than 200,000 protesters outside the company. Prosecutors told the court in northeast China that one investor had committed suicide after realizing he had been tricked. Only 1.28 million of the swindled money was recovered by the time the case was filed with the court. The intermediate People’s Court ended up sentencing Wang to death.

Number 9 is another exotic Ponzi scheme, this time based in India, where thousands of citizens were duped out of an estimated 50 million dollars. The scheme promised steady returns supposedly generated not from stocks, bonds, or even ant farms, but from raising emus, which are kind of like ostriches. MS Guru operated Susi Emu Farms, which promised investors a weekly return of a hundred and twenty dollars in exchange for a three thousand dollar investment that supposedly purchased a baby emu. Susi Emu Farms took on the obligation of raising the emu, and investors were told that the returns were possible because of the alleged value in emu meat and oil. Yes, that’s right, emu oil. The dependable returns, along with advertising featuring popular Indian film stars, caused the scheme to spread like wildfire. In total, authorities estimated that Susi Farms took in more than a hundred million dollars from at least eight thousand investors. The truth was that neither the meat nor the oil from emus was valuable. When incoming investor funds were not enough to sustain the growing obligations to existing investors, the scheme collapsed and Susi Farms executives fled town.

In an unusual turn, when it was revealed that at least a hundred thousand emus were abandoned and left to starve, the Indian government was forced to step in and purchase two hundred thousand dollars in emergency rations to feed the emus. Hopefully, they made some of that money back from emu oil. MS Guru was arrested by Indian authorities in 2012 and charged with conspiracy and cheating after the scheme unraveled.

Next up is number 8. In the 1990s, if you were young, gifted, and financially secure in Hollywood, there was a good chance that Dana Giacchetto was managing your money through his company, Cassandra. Dana’s clients included A-list stars such as Leonardo DiCaprio, Cameron Diaz, Matt Damon, Ben Affleck, and the cast members of the popular TV show Friends. He often partied in the hottest nightspots until 5:00 in the morning, often with a cockatoo perched on his shoulder to add to his cachet. Giacchetto had formed a separate hundred million dollar venture capital partnership with Chase Manhattan Bank, a Wall Street credential guaranteed to impress his glittering investors.

Before things went wrong, he was involved in legitimate deals, including brokering the sale of 49% of the record label Sub Pop, which was Nirvana’s original record label, to Warner Music Group for twenty million dollars. Cassandra turned out to be running an elaborate Ponzi scheme, taking the money new clients invested and putting it into deals gone bad in order to bail out older investors. I would argue that probably the biggest giveaway that something was wrong with these investments was quite simply that the man selling them had a cockatoo on his shoulder. If someone dresses like a pirate, it’s probably reasonable to treat them like a pirate. Leonardo DiCaprio actually lived in Dana’s Soho loft for months at a time in 1998 and 1999, becoming more and more swept away in reflected glory.

Dana began to grant press interviews, which marked the start of his unraveling. In the spring of 1999, in the presence of a reporter from The New York Times Magazine, he called out “get me Leo.” At the time, there was no one else in the room. Giacchetto began popping up in the gossip columns, even getting grouped in with Jeff Bezos and Michael Dell in an article called “The New Mini Maxi Moguls.” The LA Times reported that Giacchetto’s partnership with Chase had ended abruptly and that big-name clients including DiCaprio, Diaz, Affleck, and Damon had taken their money out of Cassandra. Rumors of an impending scandal swirled. The New York Observer caught Giacchetto in several lies: he had not dropped out two credits shy of the Harvard MBA as he claimed; in fact, he had taken only extension courses at Harvard and had failed a trader’s exam administered by the National Association of Securities Dealers. He did not have 400 million to manage as he had often stated in the press; it was actually closer to 100 million. In 2001, he was found guilty of misappropriating between five and ten million dollars of clients’ funds and was sentenced to 57 months in prison.

Coming in at number 7, we have a Florida man who went a bit too far in relying on the heavens for riches. Buddy Persaud was arrested and charged with operating a Ponzi scheme that promised risk-free returns derived from investing in the futures markets and other markets. His trading strategies were based on lunar cycles and the gravitational pull between the earth and the moon. Persaud worked for a Florida broker-dealer and also operated the White Elephant Trading Company, which he registered with the state of Florida under the names of his family members to avoid scrutiny from his employer. He solicited investors by promising risk-free annual returns of up to 18% and telling them that he was able to generate such gains through trading in futures and other markets. Unfortunately, Persaud’s astrological trading signals ended up generating more than $400,000 in losses. In addition, investor funds were used to support his lavish lifestyle. Persaud was sentenced to three years in federal prison.

At number 6, Florida authorities once again arrested four people and charged them with orchestrating a seventy-million-dollar Ponzi scheme that promised huge returns to investors who thought their returns were coming from investment in a virtual concierge machine. Investors were told that an investment in JCS Enterprises involved the purchase of a virtual concierge machine that resembled a bank’s ATM machine and allowed users to view advertisements for products or services. Investors were told that their machine would be placed in a business where it could generate lucrative profits, allowing the payout of annual returns of 80 to 120 percent. One of the ways investors were solicited to invest with JCS Enterprises was through the placement of videos on YouTube. The video promised that the VCMS would generate income for years. The alleged mastermind was also accused of soliciting investors via emails that included a Bible passage intended to create a false sense of security and appeal to the religious beliefs of investors.

At number

5, a lot of Americans are obsessed with their lawns. That’s why it should come as no surprise that there are a few Ponzi schemes out there focused on this green pastime. Those running this particular Ponzi scheme decided to focus on an expensive alternative to lawn care. Miami Beach residents Enrico Nardelli and Enrico Taurian were the founders of SJK Investment Management. SJK solicited money from investors by telling them that it was actively engaged in the trading of international bonds, including Australian and New Zealand bonds. However, Nardelli and Taurian were instead using the money to fund the operations of their business, World Wide Funding, which imported specialized grass from Italy. The grass was promoted to local governments and athletic organizations. The pair was able to raise more than 200 million dollars from investors. Nardelli and Taurian were found guilty in 2004 and each sentenced to 10 years in prison.

Coming in at number 4, we have the ponzi scheme of an Israeli man who claimed to be able to make people rich by trading diamonds. In the late 1990s, David Brookman promised investors risk-free returns through diamond trading. Brookman took in more than 15 million dollars, using a complex web of more than a dozen different entities to give the appearance that he was engaged in the legitimate business of diamond trading. In reality, Brookman was taking new investor money to pay older investors and fund his lavish lifestyle. When Brookman’s scheme began to unravel, he fled to the United States, where he was eventually arrested by the FBI in 2004. Brookman was extradited to Israel, where he was found guilty and sentenced to six years in prison.

Number 3 is an American Ponzi scheme that promised huge returns through investing in a “revolutionary” new type of water. Wayne Ogden was sentenced to 10 years in federal prison for his role in a 60 million dollar Ponzi scheme that defrauded more than 500 investors. Ogden operated Mountain West Resort Development and told investors that their money would be used to develop real estate properties. However, in reality, Ogden was using new investor funds to pay older investors and fund his lavish lifestyle. He also claimed that his investments were based on a new type of water that had been discovered in the mountains of Utah and was being marketed as a revolutionary new health product. When Ogden’s scheme began to unravel, he fled to Mexico, where he was eventually captured by authorities and returned to the United States.

Next, we have a Ponzi scheme that was based on the promise of high returns from investing in coffee shops. Patrick Daley was sentenced to 20 years in federal prison for his role in a 60 million dollar Ponzi scheme that defrauded more than 1,000 investors. Daley operated The Coffee Shop Chain, which promised investors high returns from investing in coffee shops. However, in reality, Daley was using new investor funds to pay older investors and fund his lavish lifestyle. When Daley’s scheme began to unravel, he fled to Brazil, where he was eventually captured by authorities and returned to the United States.

Finally, at number 1, we have a Ponzi scheme that promised investors high returns from investing in cattle. George Lindell and his partner Michael Rivera were sentenced to 20 years in federal prison for their role in a 40 million dollar Ponzi scheme that defrauded more than 200 investors. Lindell and Rivera operated the Investment Group, which promised investors high returns from investing in cattle. However, in reality, Lindell and Rivera were using new investor funds to pay older investors and fund their lavish lifestyles. When Lindell’s and Rivera’s scheme began to unravel, they fled to Argentina, where they were eventually captured by authorities and returned to the United States.